by Gabriele Bonafede

As largely forecasted, Brexit is proving a self-imposed tax burden on UK economy. Specifically, it is a self-imposed tax on UK’s export to EU – by far the pre-Brexit largest market for UK’s goods.

Latest bulletin of 12 march 2021 from the Office of National Statistics (ONS) confirms a catastrophic fall in export to EU. The press release, titled ‘Trade in goods saw record falls in January 2021, as trade with the EU decreased’, reported.

“Total imports and exports of goods, excluding non-monetary gold and precious metals, fell in January 2021, the largest monthly falls since records began in January 1997. These declines were driven by a 40.7% fall in exports to and a 28.8% fall in imports from the EU. In comparison, exports to non-EU countries increased by 1.7% over the same period. Earlier, there was an increase in imports and exports of goods in November and December 2020, consistent with potential stockpiling in preparation for the end of the EU transition period.”

Brexit impact a driver for GDP fall

The report highlights how non-EU trade is no position to replace UK’s trade with EU, contrary to Brexiteers’ and UK government’s propaganda. It also highlights the preeminent role of Brexit in GDP fall, even when compared to impact of Covid-19 pandemic.

The ONS report has been commented by The London Economics. “Exports of UK goods to the European Union dropped by more than two-fifths in January as the Brexit transition period came to an end. New figures from the Office for National Statistics (ONS) show that overall exports from the UK fell by £5.6 billion – 19.3 per cent. It was driven by a £5.6 billion, or 40.7 per cent, plunge in exports of goods to the EU, the ONS said. Imports also fell, by £8.9 billion overall (21.6 per cent), while imports from the EU dropped £6.6 billion (28 per cent), the figures show.”

Clearly, all trade volumes have been hit by pandemic-related restrictions. However, whereas import has steeply fallen, exports have been hit much harder. This is because the UK government has been postponing the full implementation of Brexit and related controls for import to avoid penury of critical goods.

A self-imposed tax on export

On the other hand, Brexit from EU side has been duly implemented following UK government decision to get Brexit done. This entailed the implementation of new rules imposed by UK on export to EU, thus triggering the application of larger red-tape burdens. Red tape on UK export to EU is, in fact, a tax burden for EU consumers and, above all, for UK producers. As such, Brexit is a tax on UK’s export to EU.

Whereas EU has implemented Brexit, UK government, from its side, has not. In fact, checking imported goods has proven impossible for now from UK side. Procedures to check import have been postponed and largely unapplied so far. This partially explains why official figures on import show a less dramatic fall than export. Real figure might differ, however, precisely because a lack of checking procedures helps illegal import. The extent of which is too early to estimate.

Within 2021, however, control procedure on import must be implemented, triggering a steeper fall of official import volume as well due to red tape burdens on importing too.

Boris Johnson and British fish can be happier for it. Other British goods are now happier too. They will stay in UK, with reduced chance to be exported. British people, however, can feel happier only when they believe propaganda and fake-news exported from 10 Downing Treet to the rest of UK – with the help of complancent media.

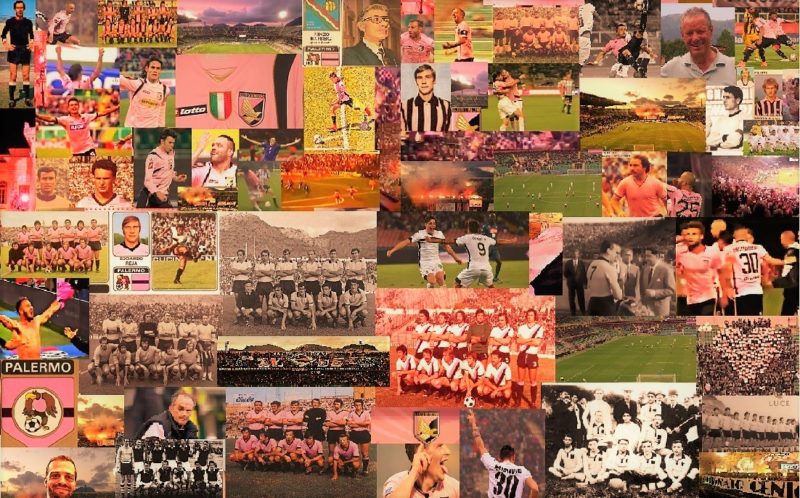

Compleanno del Palermo. Quando allo stadio c’era la gazzosa

Compleanno del Palermo. Quando allo stadio c’era la gazzosa  “Finalement”, in definitiva capiamo vivendo

“Finalement”, in definitiva capiamo vivendo  “Elisabetta, regina d’Inghilterra”: il Napoleone della Musica trionfa a Palermo

“Elisabetta, regina d’Inghilterra”: il Napoleone della Musica trionfa a Palermo  “It ends with us”, quando cambiare non è facile, per nessuno

“It ends with us”, quando cambiare non è facile, per nessuno  “Il Derviscio di Bukhara”: la magia e il fascino dell’Oriente

“Il Derviscio di Bukhara”: la magia e il fascino dell’Oriente  Kursk, continua l’offensiva ucraina. Amministrazione russa nel caos

Kursk, continua l’offensiva ucraina. Amministrazione russa nel caos