by Gabriele Bonafede

The UK’s FTSE 100 is one of the few major financial indices that hasn’t recovered from the Covid fall of 2020. Amongst major indices in Europe, only the Spanish IBEX has also not yet recovered from Covid dive of first quarter 2020.

On a monthly basis, the UK FTSE 100 reached 7542.44 points by 1 December 2019 to decline before the end of the year and again in January 2021. The US Dow Jones and Europe’s major indices started their pandemic-related fall in March – April 2021. The UK FTSE 100 started declining two months earlier – possibly due to the imminent Brexit and Boris Johnson’s general election success in December 2019.

UK FTSE 100, the worst performing index

Therefore, for the UK stock-market the decline has been both more prolonged and deeper. Not surprisingly, the UK economy posted the steepest plunge in GDP as well, for 2020. Thus it added the negative impact of Brexit to the Covid crisis.

The problems of the UK FTSE did not end with a steep plunge. While the recovery of other major indices has been spectacular since the end of 2020 summer, the British index has not yet fully recovered. By 1st of July 2021, it still stood at a lower level than that reached before the Covid pandemic at 7,125.15 points, well below the 7,542.44 points of 1st December 2019 – which is -417.29 points, or 5.5% lower.

With economic recovery being hampered by post-Brexit trade problems, inflation and goods/labour shortages, future developments might not be very bright. This, coupled with steep resurgence of Covid Delta variant cases, add to a worrisome outlook unless other factors can offset these results.

UK FTSE 100 lagging behind, others are booming

On the other hand, all other major indices – and competitors – of Europe and US have posted higher levels. Most of them, such as US Dow Jones, German DAX, French CAC 40 and even Italy’s MIB FTSE, have posted spectacular recovery from the Covid dive of spring 2020 (pictured, source https://www.investing.com/indices/major-indices).

The Dow Jones increased from pre-pandemic 28,538.44 to above 34,570. That is a hefty increase of more than 6,000 points, or +21.1%.

In the same period, German DAX increased by almost 18% compared to the pre-pandemic level. The French CAC 40 increased by almost 10% and the Italian MIB FTSE by around 7.5%.

As expected, the Dutch AEX (Amsterdam) index posted the most spectacular recovery among major indices in Europe, similar to Dow Jones: a +21% compared to a pre-pandemic peak (1st December 2019).

Brexit to blame

The difference is clear and predictable. In fact, it is fairly obvious that Brexit is playing a role on expectations, the real economy and financial performance. The UK economy is paying a high price in terms of reduced trade capacity as well as reduced production capacity.

Lockdown has been certainly playing a role. But that applies to everyone. For the UK the additional drawbacks come precisely from Brexit, as a simple and general long-term analysis of financial indices and stock-markets – on a monthly basis – demonstrate. In fact, the decline of UK FTSE 100 started with the final say of British voters for December 2019 elections – confirming Brexit – with subsequent missed recovery once the first three waves of Covid cases were over.

Now a new and difficult phase is looming, with the Delta variant playing a role and Brexit-driven drawbacks adding to it.

Meanwhile, more Brtish fish are unhappy about Brexit.

On cover photo by James Padolsey on Unsplash. Full photo here .

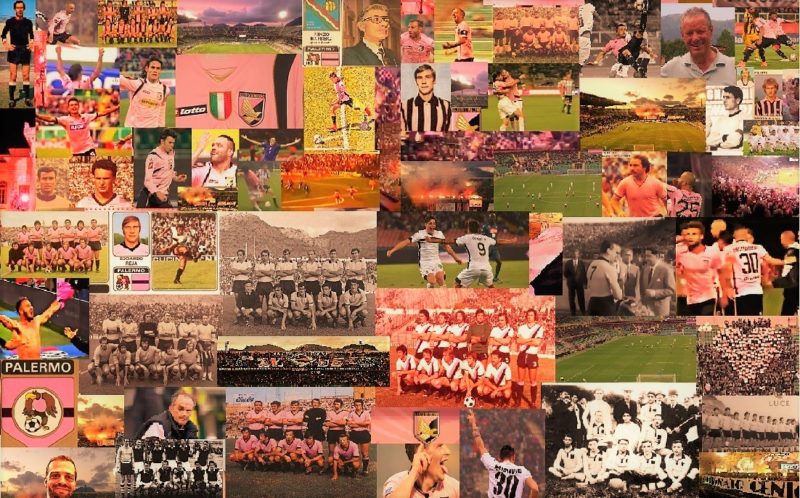

Compleanno del Palermo. Quando allo stadio c’era la gazzosa

Compleanno del Palermo. Quando allo stadio c’era la gazzosa  “Finalement”, in definitiva capiamo vivendo

“Finalement”, in definitiva capiamo vivendo  “Elisabetta, regina d’Inghilterra”: il Napoleone della Musica trionfa a Palermo

“Elisabetta, regina d’Inghilterra”: il Napoleone della Musica trionfa a Palermo  “It ends with us”, quando cambiare non è facile, per nessuno

“It ends with us”, quando cambiare non è facile, per nessuno  “Il Derviscio di Bukhara”: la magia e il fascino dell’Oriente

“Il Derviscio di Bukhara”: la magia e il fascino dell’Oriente  Kursk, continua l’offensiva ucraina. Amministrazione russa nel caos

Kursk, continua l’offensiva ucraina. Amministrazione russa nel caos